The Federal Reserve raised its inflation forecast 1.0% for this year to 3.4% and indicated inflation will stay near its target of 2.0% in coming years. Based on a more rapid recovery and higher-than-expected inflation in recent months, Fed officials estimate the Fed will raise interest rates twice in 2023. The moves also suggest the Fed will start reducing its bond-buying program this year rather than in 2022.

Key Points for the Week

- The Federal Reserve raised its estimate for inflation and signaled it may reduce bond purchases and raise interest rates sooner than expected.

- S. retail sales remain at elevated levels despite falling 1.3% last month in the face of higher prices. Clothing sales grew more rapidly than other sectors.

- China continues to emphasize industrial companies over retail sales as industrial production rose 8.8%.

U.S. consumers also reacted to higher inflation, by slowing down purchases. Retail sales fell 1.35% compared to last month. Some decline is expected as the stimulus-boosted purchases of recent months will be tough to surpass. Chinese industrial production surged 8.8% over the last year as China continues to focus on industrial growth rather than a retail recovery.

Stocks struggled toward the end of the week as investors wrestled with the Fed’s communication. The S&P 500 sagged 1.9%, with most of the decline coming during Friday’s move lower. The MSCI ACWI also fell 1.9%. Bonds inched higher as the Bloomberg BarCap Aggregate Bond Index added 0.1%.

This week’s reports will include updates on trade, home sales, and durable goods. The Personal Consumption Expenditures report, which includes updates on income and inflation, will also be published.

Figure 1

Three Responses to Rising Inflation

Inflation has been the topic of greatest interest to investors in recent weeks. Most market conversations with investors have included a longer than normal discussion about where inflation is headed and how high it might go. This week’s Fed meeting and economic activity detailed how the Federal Reserve, companies, and consumers are responding to concerns inflation is climbing higher.

The Federal Reserve

The Fed showed signs of grappling with the increasing inflation while wanting to reassure investors. Fed economists raised their 2021 inflation forecast from 2.4% to 3.4% as higher prices in recent months forced an upgrade to future expectations. Official Fed estimates showed they expected the jump in prices to moderate in the future. Expectations for 2022 and 2023 were only raised 0.1% and are now just above the 2.0% target.

There are signs the estimates are causing some Fed officials to reassess how quickly to adjust monetary policy. A group of 18 Fed officials, including all the regional governors, shared their estimates of where rates would be in future years. The revised projections show 13 of the 18 members expect a rate hike by the end of 2023. That number nearly doubled from estimates shared in March, before inflation started moving higher. The number expecting a hike in 2022 moved from four to seven.

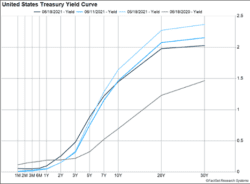

Before raising rates, the Fed is more likely to slow down its purchases of bonds. The strategy, called quantitative easing, is designed to keep longer-term rates low by having the Fed purchase the debt directly from the government or government entities. Some observers expect the Fed to slow down the $120 billion in bond purchases as soon as September.

Companies

One of the causes of increased inflation has been supply shortages in key inputs, such as lumber and semiconductors. Those shortages have caused spikes in the price of housing and used vehicles, as the lack of semiconductors has slowed the production of new vehicles. The effect on prices of goods has been strong. Producer prices jumped 0.8% last month and are up 6.5% in the last year.

These price jumps have likely contributed to investors’ worries about inflation. But the Fed anticipates the supply shortages will turn and prices will fall. Lumber prices are a good example of how prices can move. Lumber futures have dropped 41% from the recent high and fallen 14 of the last 16 trading days.

Consumers

Consumers are responding to higher prices by slowing down purchases. Retail sales dipped 1.3% last month as the impact from stimulus checks faded and consumers reacted to higher prices by stepping back from purchases. The stimulus checks likely pushed short-term demand higher than capacity allowed, and some slowing demand may take the pressure off prices in key areas.

Consumers are increasing purchases in areas associated with reopening. Restaurants and bars experienced additional demand. Clothing sales grew rapidly, rising 3% from last month, and are up more than 200% from last year. High vehicle prices contributed to a 3.7% decline in sales from last month, and the home improvement sector experienced a 5.9% decline from April.

Conclusion

Our view is the surge in inflation will likely prove temporary. Improved supply in some key market segments should reign prices in, even if the decline isn’t as rapid as the plummeting lumber prices. What we find most puzzling is the market commentary on how the Fed is becoming more hawkish. Rates may go up sooner than expected, but the Fed is unlikely to take any action on interest rates for more than a year. The support the economy and stock market are receiving from low interest rates seems poised to last longer.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://blog.pimco.com/en/2021/06/june-fomc-meeting-flexible-expectations-targeting

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.federalreserve.gov/releases/g17/20210615/g17.pdf

Compliance Case #01063283